If you are a farmer or business owner, we want to let you know that you could be eligible for a 2017 tax deduction when you upgrade to a new truck, large SUV or Transit Van at Sioux Falls Ford Lincoln by the end of December.

Here’s what you should know

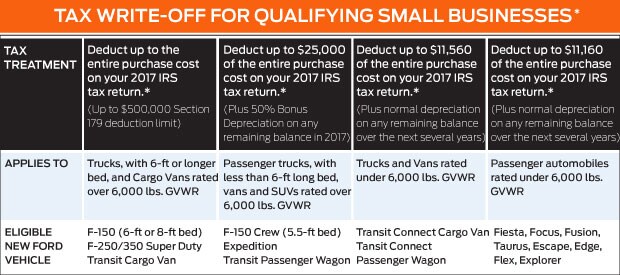

Thanks to IRS Section 179 of the IRS tax code, many small businesses that invest in new equipment, including qualifying new vehicles, will be able to write-off up to $500,000 of theses purchases on their 2017 IRS tax returns.

Normally, businesses spread these deductions over several years. But now, with tax benefits provided under IRS Section 179, many small businesses can write-off up to the entire purchase cost of one or more qualifying new Ford trucks, vans or SUVs.

Things to remember

The qualifying vehicle must be purchased and placed into service between January 1, 2017 and December 31, 2017. It must be used at least 50% for business, based on mileage, in the first year it is placed in service. Vehicles used for both business and personal purposes would deduct the percentage used for business.

What’s the urgency?

There is only one month left to purchase your new business vehicle. Sioux Falls Ford Lincoln has every type of vehicle that businesses need. Shop all of our inventory online, or see our expanding commercial vehicle inventory. Give us a call or visit us at 4901 West 26th Street to take ownership of your new Ford before the year runs out.

*This analysis is provided as a public service to customers. It should not be construed as tax advice or as a promise of potential tax savings or reduced tax liability. Consult your tax professional prior to any vehicle transaction. For more information about the Section 179 expense write-off or other vehicle write-offs, contact your tax professional and visit the Internal Revenue Service website at www.irs.gov